Real estate is good! The central bank and the General Administration of Financial Supervision have made a heavy voice!

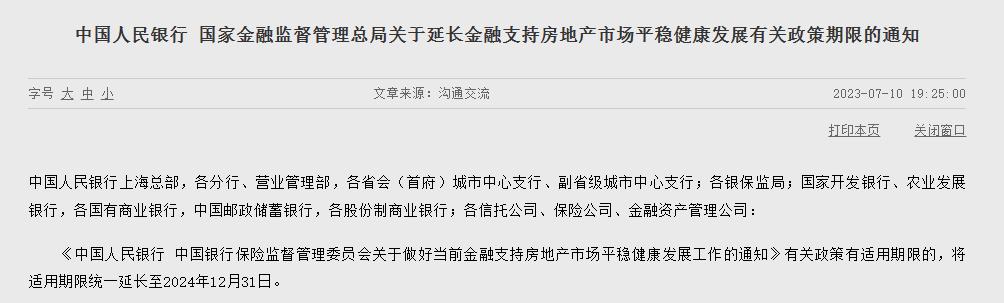

The People’s Bank of China and the State Financial Supervision and Administration Bureau issued a notice on July 10th, saying that if the relevant policies in the Notice of the People’s Bank of China and the Insurance Regulatory Commission of the Bank of China on Doing a Good Job in Financial Support for the Stable and Healthy Development of the Real Estate Market have an applicable period, the applicable period will be uniformly extended to December 31st, 2024.

Image source: China People’s Bank website

People close to the regulators said that the promulgation of the Notice of the People’s Bank of China and the State Financial Supervision and Administration on Extending the Policy Term of Financial Support for the Stable and Healthy Development of the Real Estate Market will ease the financial pressure of real estate development enterprises, reduce the risk concerns of financial institutions on housing loans, and further improve the policy environment for financial institutions to support the stable and healthy development of the real estate market.

Extend the applicable period of relevant policies.

On November 11, 2022, the People’s Bank of China and the former China Banking and Insurance Regulatory Commission jointly issued the Notice on Doing a Good Job in Financial Support for the Stable and Healthy Development of the Real Estate Market (hereinafter referred to as the Notice), which defined 16 support policies, including keeping the real estate financing stable and orderly, actively doing a good job in the financial service of guaranteeing the delivery of buildings, cooperating with the risk management of trapped real estate enterprises, and increasing financial support for housing leasing, and two of them stipulated the applicable period.

In response to a reporter’s question, the responsible persons of the People’s Bank of China and the General Administration of Financial Supervision said that after the promulgation and implementation of the Notice, it has played a positive role in maintaining reasonable and moderate real estate financing and promoting the resolution of risks of real estate enterprises, and achieved good policy results. Considering the current situation of the real estate market, in order to guide financial institutions to continue to extend the stock financing of real estate enterprises and increase the financial support of Baojielou, the People’s Bank of China and the State Financial Supervision and Administration Bureau decided to extend the application period of relevant policies.

Specifically, the policy extension involves two aspects. The above-mentioned person in charge introduced: First, for stock financing such as development loans and trust loans of real estate enterprises, on the premise of ensuring the security of creditor’s rights, financial institutions and real estate enterprises are encouraged to negotiate independently on the basis of commercial principles, and actively support them through stock loan extension and adjustment of repayment arrangements to promote the completion and delivery of the project. If it expires before December 31, 2024, it may be allowed to extend beyond the original provisions for one year, and the loan classification may not be adjusted, and the loan classification submitted to the credit information system is consistent with it.

Second, for the matching financing issued by commercial banks to special loan support projects before December 31, 2024 in accordance with the requirements of the Notice, the risk classification will not be lowered during the loan period; The borrower after the new and old debts are written off shall be managed according to the qualified borrower. If the newly issued matching financing is not good, and the relevant institutions and personnel have done their duty, they can be exempted.

"To a certain extent, this will dispel the concerns of financial institutions, further change the situation that financial institutions are afraid and unwilling to lend, encourage financial institutions to issue matching financing to special loan support projects, further improve the financing of real estate enterprises, stabilize market confidence and expectations, and promote the stable and healthy development of the real estate market, and better help the sustained recovery of the macro economy." Dong Ximiao, chief researcher of Zhaolian, said.

In addition, the person in charge stressed that in addition to the above two policies, other policies that do not involve the application period are long-term effective. All financial institutions should earnestly implement it in accordance with the requirements of the documents, support rigid and improved housing demand due to the city’s policies, maintain reasonable and moderate real estate financing, increase financial support for Baojiaolou, promote the marketization of industry risks, and promote the stable and healthy development of the real estate market.

More support policies are expected to be accelerated.

In order to promote the stable and healthy development of the real estate market, many experts believe that more follow-up support policies are expected to be accelerated.

According to Pang Ming, chief economist and research director of Jones Lang LaSalle Greater China, at present, the pace and intensity of the recovery of the supply side of the real estate market still lags behind that of the sales side, the growth rate of newly started area and construction area has slowed down, the area for sale has been rising for many months year-on-year, and the consumption chain related to the downstream of real estate is still in the early stage of recovery. Real estate enterprises still need continuous support and care from policies.

Wen Bin, chief economist of Minsheng Bank, said that the follow-up real estate continuity policy is expected to be introduced to prevent debt risks and restore a virtuous circle of the real estate chain. At the same time, we will make greater efforts to promote the "guarantee building", further compact the responsibility of local governments, and promote banks to increase financial support on the basis of the principle of commercialization.

"The next step is to comprehensively adjust and optimize the real estate financial policy and extend the transition period of real estate loan concentration management; Increase liquidity support for high-quality real estate enterprises through measures such as’ three arrows’ and special loans from policy banks, and continue to increase special support for the’ Baojiaolou’ project; Support the reasonable extension of stock financing such as development loans and trust loans; At the same time, according to local conditions, due to urban policies and district policies, accelerate the adjustment and optimization of housing credit policies. " Dong Ximiao said.

Editor: Zhang Nan Wang Yin