Real estate policy timely adjustment and optimization.

Core reading

In order to adapt to the new situation that the relationship between supply and demand in China’s real estate market has undergone major changes, recently, many places and departments have issued intensive documents to adjust and optimize real estate policies in a timely manner, which will better meet the rigid and improved housing needs of residents, and will also have a favorable impact on expanding consumption, stimulating investment and stabilizing economic growth.

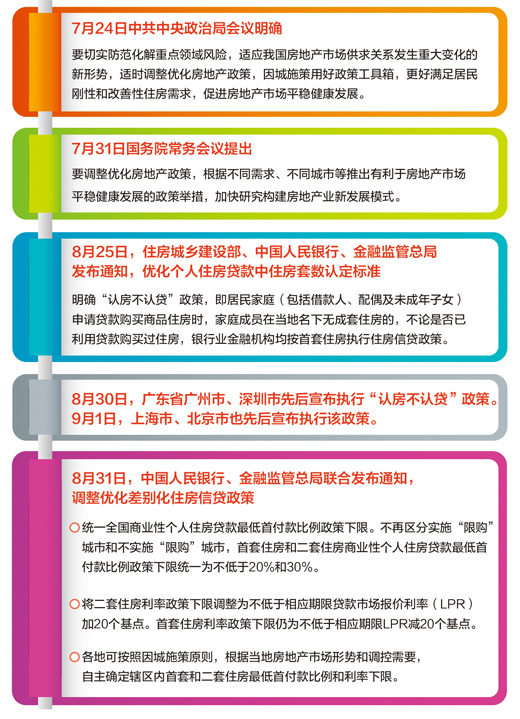

On August 30th, Guangzhou City and Shenzhen City of Guangdong Province successively announced the implementation of the policy of "recognizing houses but not loans". On September 1, Shanghai and Beijing also announced the implementation of this policy.

On August 31st, the People’s Bank of China and the State Financial Supervision and Administration jointly issued a notice, which unified the minimum down payment ratio of the first and second sets of commercial personal housing loans to be no less than 20% and 30%. At the same time, reduce the interest rate of the first home loan in stock.

Experts pointed out that in recent days, many departments have issued intensive documents, adjusted and optimized real estate policies in a timely manner, and released positive signals to promote the stable and healthy development of the real estate market.

The policy plays a "combination boxing" to better meet the rigid and improved housing needs of residents.

The policy of "recognizing the house but not the loan" is clear. When households (including borrowers, spouses and minor children) apply for loans to buy commercial housing, if family members do not have a complete set of housing in the local name, banking financial institutions will implement the housing credit policy according to the first set of housing, regardless of whether they have used loans to buy housing.

"For families who need to change rooms, in ‘ Admit the house but not the loan ’ Under the policy, houses can be exchanged at a lower down payment ratio and a more favorable loan interest rate, and the preferential period of personal income tax rebate for residents to purchase houses has also been extended. These policies will help reduce the cost of buying houses and release the demand for changing houses. " Pu Zhan, deputy director of the Policy Research Center of the Ministry of Housing and Urban-Rural Development, introduced.

Jiang Nan has worked in Guangzhou for more than 10 years. In 2015, just before she got married, she first bought a wedding room in Foshan City, Guangdong Province, and rented it out after simple decoration, while she rented a house in Guangzhou. In the past two years, seeing that the children have reached the age of going to school, the desire of Jiang Nan and his wife to buy a suite in Guangzhou has become stronger and stronger.

"I saw more than a dozen sets of second-hand houses, and I was satisfied. Almost all of them cost more than 6 million yuan. Before that suite in Foshan also had a loan, now I want to buy this suite, with a down payment of 40% and a loan interest rate of 4.8%. " Jiang Nan said that according to the new policy of "recognizing the house and not recognizing the loan", the down payment is only 30%, and the down payment is less than 10%, which is more than 600,000 yuan; Moreover, the loan interest rate enjoys 4.2% of the first suite interest rate, and the monthly supply burden can also be reduced a lot.

Ms. Huang, a citizen of Shenzhen, also expressed a similar idea: "We have always wanted to change a bigger house and improve our living conditions. However, if it is identified as a second suite, the down payment ratio is high and it is difficult to bear. After the introduction of the New Deal, the pressure is much smaller. "

Gao Yuan, president of Beijing Chain Home Research Institute, believes that "recognizing houses but not loans" mainly benefits new citizens and improved groups in Beijing. In terms of new citizens, it is more common that they have no house in Beijing, but they have had a credit record of buying a house in other places. Under the original standard, they have to pay 60% (ordinary house) or 80% (non-ordinary house) down payment for buying a house in Beijing; In terms of improved groups, it is beneficial to "sell one and buy one" to improve the replacement groups. Due to factors such as family structure changes, child care and old-age care, nearly 70% of buyers in the current Beijing residential market belong to improved demand.

What is the market reaction after the introduction of policies such as "recognizing houses but not loans"? Lou Chunlei, manager of an active regional store in Chaoyang District, Beijing Chain Home, told reporters that after Beijing announced the policy, we received many customers’ consultation calls one after another. In the first two months, the number of online consultations was generally more than 20, and this weekend it increased to more than 60, and the number of regional listings was also active. "The price of the target room type of our improved customers is mostly between 8 million yuan and 10 million yuan. Before looking at the house, considering that 80% of the second-home down payment was hesitant, now the policy has landed, and many customers have chosen to list the property to obtain the first set of qualifications. " Yan Chunlei said.

According to the data provided by RealData, the average daily turnover of second-hand houses in Guangzhou and Shenzhen increased by 25% and 70% respectively from August 30 to 31, compared with last week (August 21 to 27), and the number of customers taking care of them also increased rapidly.

Not only the policy of "recognizing the house but not the loan", but also the policies of adjusting and optimizing differentiated housing credit and reducing the interest rate of the first home loan in stock will also help to better meet the demand for rigid and improved housing.

According to the relevant persons in charge of the People’s Bank of China and the General Administration of Financial Supervision, the key points of the adjustment and optimization of differentiated housing credit policy include two aspects: First, unify the lower limit of the national minimum down payment ratio policy for commercial individual housing loans. No longer distinguish between cities that implement "restricted purchases" and cities that do not implement "restricted purchases", and the lower limit of the minimum down payment ratio of commercial personal housing loans for the first home and the second home is unified to not less than 20% and 30%. The second is to adjust the lower limit of the second set of housing interest rate policy to not less than the loan market quotation rate (LPR) of the corresponding term plus 20 basis points. The lower limit of the first set of housing interest rate policy is still not less than the corresponding period LPR minus 20 basis points. All localities can independently determine the minimum down payment ratio and the lower interest rate limit of the first and second houses within their jurisdiction according to the principle of city-specific policies and the local real estate market situation and regulatory needs.

The real estate market as a whole has turned into a buyer’s market where supply exceeds demand.

The real estate chain is long and involves a wide range, which can be said to lead the whole body.

In the second quarter of this year, affected by the macro-environment, residents’ ability and willingness to buy houses declined, and the recovery of buying houses as a bulk consumption lagged behind, and the growth rate of real estate market turnover slowed down. From January to July, the sales area of commercial housing was 665.63 million square meters, a year-on-year decrease of 6.5%; The newly started housing area was 569.69 million square meters, down by 24.5%.

On July 24th, the Political Bureau of the Communist Party of China (CPC) Central Committee held a meeting and pointed out that it is necessary to effectively prevent and resolve risks in key areas, adapt to the new situation that the supply and demand relationship in China’s real estate market has undergone major changes, adjust and optimize real estate policies in a timely manner, and make good use of the policy toolbox to better meet the rigid and improved housing needs of residents and promote the stable and healthy development of the real estate market.

Yu Xiaofen, Dean of China Institute of Housing and Real Estate, Zhejiang University of Technology, analyzed that the relationship between supply and demand in the real estate market has undergone major changes, mainly in three aspects: First, it has shifted from the seller’s market to the buyer’s market. After more than 20 years of large-scale development, the per capita housing construction area of urban residents in China has exceeded 41 square meters in 2022. Due to the negative growth of superimposed population and the middle and late stage of urbanization, the market as a whole has turned into a buyer’s market with oversupply, especially in small and medium-sized cities, where the inventory of commercial housing is large and the cycle of de-melting is long. The second is to shift from an incremental market to a stock-based market. In many cities, the growth rate of stock housing transactions is faster than that of new commercial housing sales, and the turnover of second-hand houses in some cities has exceeded that of new houses. Third, the proportion of existing home sales has steadily increased from auction sales to existing home sales.

"Adapting to the new situation that the relationship between supply and demand in China’s real estate market has undergone major changes, the implementation of a series of policies and measures in recent days can not only better meet the rigid and improving needs of residents, but also have great significance for expanding consumption, stimulating investment and stabilizing economic growth." Yan Xiaofen believes.

Dong Ximiao, chief researcher of Zhaolian, said that according to relevant calculations, the average decline in the interest rate of the first home loan was about 80 basis points. Take the stock mortgage with a term of 1 million yuan, 25 years and the original interest rate of 5.1% as an example. Assuming that the mortgage interest rate is reduced to 4.3%, the borrower’s repayment expenditure can be saved by more than 5,000 yuan per year, which will help reduce the housing consumption burden and increase the consumption and investment capacity of residents.

To promote the stable and healthy development of the real estate market, we need to be patient in many ways.

Experts interviewed said that the current timely adjustment and optimization of real estate policies has opened the market expectation window. In the short term, just-needed and improved demand will be concentrated in the market, and the market transaction volume may increase significantly before the end of the year. However, as a whole, the relationship between supply and demand in the real estate market has changed greatly, and it is greatly influenced by the macro environment. To look at the development of the real estate market with a more rational attitude, we must have both confidence and patience.

"When the overall development of the market slows down, the positive side will be particularly noticeable. For example, some markets will be more resilient and new business opportunities will emerge." Yu Liang, Chairman of Vanke’s Board of Directors, believes that the urbanization rate in China is about 65% at present, and it is expected to reach 70% in 2030, and the urban population will increase to about 980 million. According to the construction experience, it is conservatively estimated that the newly started real estate area of 1 billion to 1.2 billion square meters in the future is guaranteed.

Yu Liang said that according to the experience of London, Tokyo and other cities, the population will continue to concentrate in cities that can create jobs. Even after the market is fully mature, there will still be a large number of urban renewal projects in the central city to enhance the development vitality of traditional areas and meet the needs of job-residence balance. In addition, the construction of affordable rental housing, the renovation of villages in cities, and the construction and operation of real estate agents will also be important business growth areas in the future.

"The current policy is already exerting strength. I believe that with the joint efforts of all parties, as the economic operation continues to improve and the expectations for the future gradually stabilize, the market will return to a healthy and reasonable level." Yu Liang said.

Yan Xiaofen believes that in the medium and long term, to promote the stable and healthy development of the real estate market, we need to focus on both supply and demand: stabilize the market scale by accelerating the start of urban renewal and urban village transformation; By lowering the mortgage interest rate and expanding the coverage of housing provident fund, we will strive to improve the housing consumption capacity, relax the purchase restriction in big cities or districts where the relationship between housing supply and demand has undergone major changes, and stabilize market demand; By comprehensively promoting the "mortgage transfer" of second-hand houses, reducing transaction deed tax and reasonably reducing real estate agency fees, we will encourage trade-in and promote a virtuous circle of the market; Support high-quality state-owned housing enterprises and high-quality private housing enterprises equally, appropriately relax the restrictions on development conditions and stabilize real estate enterprises.

The relevant person in charge of the Ministry of Housing and Urban-Rural Development said that we will continue to focus on increasing confidence, preventing risks and promoting transformation to promote the stable and healthy development of the real estate market. Because of the city’s policy and precise policy, we will vigorously support the demand for rigid and improved housing, solidly promote the work of ensuring the people’s livelihood and stability, resolve the risk of corporate capital chain breakage, strive to improve quality, build a good house, rectify the order of the real estate market, and let the people buy houses and rent houses with confidence.