Why is Meng Qi, the largest English training institution for children in Hong Kong, a thousand miles away?

Meng Qi Qianli, a local English training institution for children in Hong Kong, submitted an application for listing in Hong Kong.

Author | Matcha Latte

Source | IPO that thing

Data Support | Pythagorean Big Data

Friends who like to watch variety shows have probably seen a program of Hunan Satellite TV called "Where is Dad going?". In the program, two small Hong Kong men-Feynman, the son of Wu Zhenyu, and Jasper, the son of Jordan chan-are both very popular second generation stars. Apart from being from Hong Kong, they all have one obvious thing in common, that is, they all speak fluent English, which is also one of the great highlights of the program. Outside the program, we can easily conclude that Hong Kong people attach importance to English from dolls, which largely depends on the historical development, cultural atmosphere, economic strength, government support and other factors of the city. Including the author’s study in Hong Kong, I also found that most of the Local students around me are proficient in English, which must be inseparable from their childhood language influence.

In addition to the training of schools and families, extracurricular English training institutions are naturally indispensable. According to the consulting report, from 2014 to 2018, the tuition income of English learning centers for children (aged 2 to 12) in Hong Kong increased from 1.379 billion (HK$, the same below) to 2.056 billion, with a compound annual growth rate of 10.5%, and will continue to grow to 3.327 billion from 2018 to 2023.

On July 8th, Meng Qi Qianli Group Holding Co., Ltd. (hereinafter referred to as "Meng Qi Qianli"), a local children’s English training institution in Hong Kong, submitted an application for listing in Hong Kong, showing that the exclusive sponsor was Ballas Capital. Meng Qi Qianli was established in 2009, mainly providing English courses for children aged 3-12. At present, there are 77 Monkey Tree learning centers, and about 96% of its income comes from the Hong Kong market.

In this way, the business involved in Meng Qi Trinidad should be regarded as a good business in Hong Kong. Then, can Meng Qi’s next capital road be smooth?

one

The largest supplier of English learning courses for children in Hong Kong market.

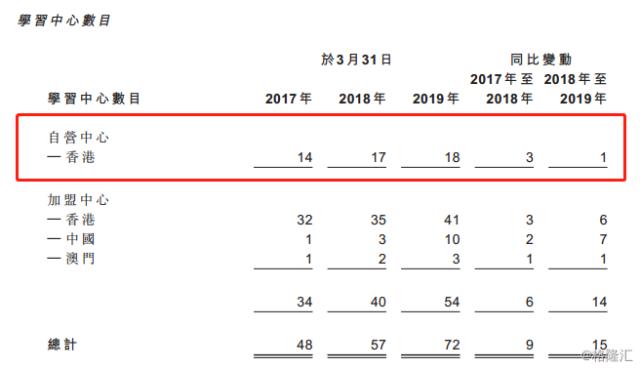

Meng Qi Qianli is a Hong Kong-based English learning course provider for children, which mainly provides English courses for students aged 3 to 12 under the brand of "Monkey Tree". Up to now, there are 77 Monkey Tree learning centers in Meng Qi Qianli, including 18 self-operated centers in Hong Kong and 43, 3 and 13 franchised centers in Hong Kong, Macau and China.

According to the consulting report, children’s English learning industry in Hong Kong is still relatively scattered, and competition is expected to intensify in the future. According to the revenue in 2018, the total market share of the five major market participants is about 29.5%, among which Meng Qi Qianli ranks first with a market share of about 9.9%.

As far as courses are concerned, most of Meng Qi Qianli employ English-speaking teachers to educate students in a relatively small-scale learning environment, with no more than eight students in each classroom, thus improving the teaching quality through close interaction with teachers. At the same time, Meng Qi Qianli also indicated in the prospectus that it would design interactive activities and games for the classroom, such as singing and role-playing, to stimulate students’ interest and stickiness.

It is worth noting that the Monkey Tree Learning Center (self-operated+franchised) of Meng Qi Qianli Line is unified in the process of site selection and opening, teacher recruitment, training and support, marketing, curriculum outline and course textbook production, and can enjoy a certain degree of economies of scale and reproducibility.

two

The business income structure is single, and the future expansion growth rate is doubtful.

Let’s take a look at the financial performance of Meng Qi Qianli. Note that the node of its financial year is March 31st every year.

In fiscal years 2017, 2018 and 2019, the Monkey Tree Learning Center enrolled 14,745 students, 17,023 students and 19,248 students respectively, among which 4,635 students enrolled in the self-operated center, 6,103 students enrolled in the self-operated center and 6,793 students enrolled in the franchise center, respectively.

From the perspective of revenue structure, Meng Qi Qianli’s revenue mainly comes from self-operated centers, accounting for 92.7%, 92.8% and 92.2% of the total revenue in fiscal year 2017-2019, respectively, while the total revenue of affiliated centers and facilities does not exceed 8% of the total revenue, resulting in a relatively simple revenue structure of the company. In terms of regional distribution, since the company’s 18 self-operated centers are all located in Hong Kong, its revenue mainly comes from Hong Kong, accounting for 98.8%, 98% and 96% of the total revenue in fiscal year 2017-2019, respectively, while Macau and Chinese mainland account for very little. The income structure and regional distribution are relatively simple, which will hinder the sustained growth of Meng Qi Qianli’s future income. In particular, the English learning market for children in Hong Kong is still scattered, with fierce competition, and the size and space of the population are relatively limited compared with the mainland.

At the same time, although it is the "main force" of Meng Qi Qianli business, the operating conditions of Monkey Tree self-operated center in Hong Kong have been deteriorating in recent years. In fiscal years 2017, 2018 and 2019, four, three and two were added (one was closed) respectively, and the local expansion was slightly weak. In FY 2019, the number of students enrolled in the self-operated center of Meng Qi Qianli increased by 11.3% year-on-year, which was slightly lower than that of the affiliated center (14.1%).

Facing the resistance of business expansion, on the one hand, Meng Qi Qianli decided to enhance the competitiveness of self-operated centers and franchise centers, systematically renovate Hong Kong self-operated centers and franchise centers in the future, and develop online teaching research and teaching teams. On the other hand, the company also plans to establish branches in mainland cities such as Shenzhen, Shanghai, Chengdu, Guangzhou, Guiyang, Hangzhou, Foshan, Huizhou and Zhongshan, and extend its self-operated centers out of Hong Kong.

In terms of net profit, in fiscal years 2017, 2018 and 2019, Meng Qi Qianli recorded 13.678 million, 14.063 million and 19.264 million respectively, with growth rates of 2.8% and 37.0%. In fiscal year 2019, the company’s net profit increased greatly, mainly due to the improvement of operating efficiency, and the net profit increased by 1.7 percentage points to 11.2%. Among them, the advertising and promotion expenses of the company accounted for only about 2.2% of the total revenue during the period, and the cost of obtaining customers was low, thanks to the excellent popularity of Monkey Tree in Hong Kong. However, if the company enters the mainland market in the future and stands out among many extracurricular brands, it is necessary to increase the publicity of "burning money" and the profit rate is difficult to maintain. More importantly, there is also uncertainty about the effect obtained after vigorous publicity.

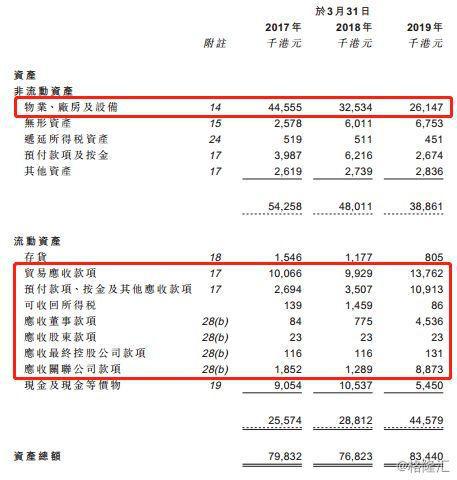

In addition to the pressure of business expansion, Meng Qi Qianli is a little strange in assets. For example, in FY 2019, although the total assets in Meng Qi Qianli’s account increased year-on-year, the fixed assets in current assets dropped sharply, which was replaced by the increase in receivables in current assets, including many sensitive transactions such as directors and affiliated companies.

three

Is it happy or sad that the sprint capital hits the compulsory education "citizens recruit together"?

Interestingly, on July 8th, the same day that Meng Qi Qianli submitted its application for listing, the State Council issued the Opinions on Deepening Education and Teaching Reform and Improving the Quality of Compulsory Education in an All-round Way. According to the opinion, the enrollment of private compulsory education schools is included in the unified management of examination and approval, and enrollment is synchronized with public schools; If the number of applicants exceeds the enrollment plan, computer random admission will be implemented.

For training institutions, under the dual influence of citizens’ common recruitment and over-computer random enrollment in private schools, the trend and uncertainty of parents’ school choice have been further enhanced, and the willingness and demand for subject-based remedial training caused by anxiety for further studies have cooled down, which may not be a good thing for K12 extracurricular training institutions, and may have a certain negative effect on Meng Qi Qianli, which intends to develop its business in mainland China.

Although it is the first English learning brand for children in Hong Kong, it should be certain that Meng Qi Qianli will enter the mainland in a large scale in the future if it wants to seek sustained and rapid growth in profits. However, there are many brands of children’s extracurricular learning online and online in the Mainland. In order to gain a foothold, the brand "Monkey Tree" will inevitably need to increase investment in advertising and marketing, which may put pressure on the company’s short-term net interest rate. In the absence of unique business characteristics in the learning center, there are doubts about whether the brand can successfully open the market. Riding the wind of the reform and upgrading of compulsory education, how should Meng Qi take the next road?

Disclaimer: The content is for reference only. Please make investment decisions carefully according to it.

Reporting/feedback